“Every year we gain and lose a few members. Every month members pay their fees. Every week green fees are paid and every day our pro shop and bar has takings. We pay our staff monthly, we cut our grass daily, the last thing we wish to do is to pay upfront for equipment that will last us five years.

Leasing makes our life so much easier from so many points of view. We can work out the cost of a locker per day, or how much a buggy will cost per round. We can fix our overheads and budget effectively and on the large value assets such as turf care, we can structure the rental repayments over summer months, keeping our cash flow in order in winter.

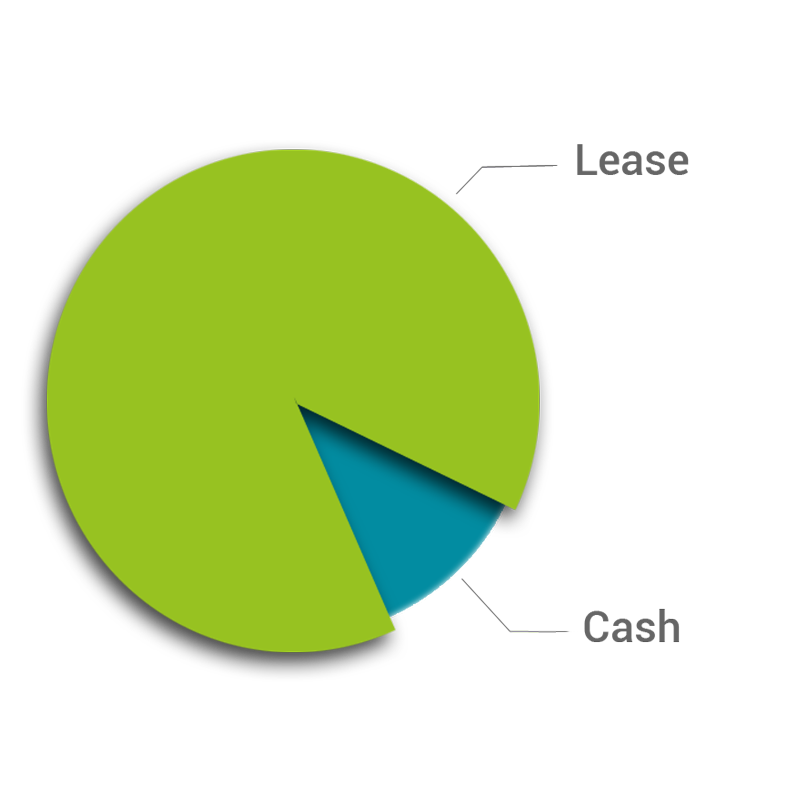

It doesn’t surprise us that 90% of clubs will use leasing as a form of financing assets.”

Partner login

Partner login